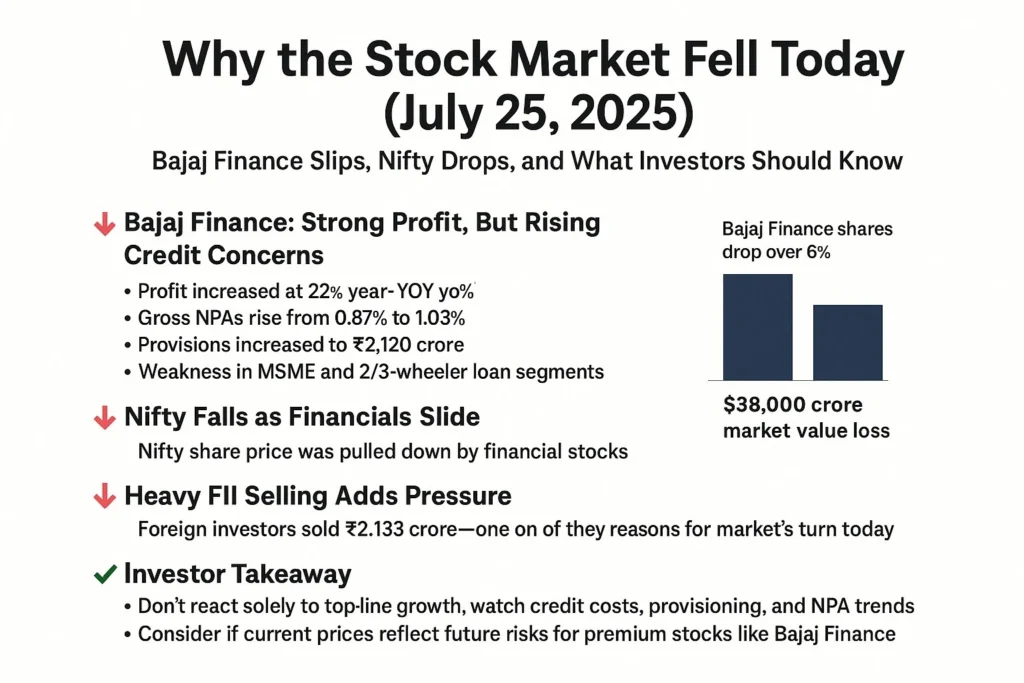

The stock market today, July 25, 2025, opened in the red and stayed weak. The Sensex dropped over 600 points, while the Nifty 50 share price fell below 24,900. Leading the fall? Bajaj Finance shares, which tumbled over 6% despite posting strong earnings.

Here’s a clear look at why the market is falling today, and what it means for investors.

1. Bajaj Finance: Strong Growth, But Credit Worries

Bajaj Finance reported a solid 22% year-on-year profit rise. But investors were more concerned about:

- A jump in gross NPAs from 0.87% to 1.03%

- Higher provisions (₹2,120 crore)

- Stress in MSME and 2/3-wheeler loan portfolios

Despite strong growth in customer base and loan book, the rising stress led to downgrades from analysts—and a big hit to the Bajaj Finance share price.

2. Nifty Dragged by Financials

The Nifty share price fell as Bajaj Finance pulled down other financial stocks too. HDFC Bank, Axis Bank, and Kotak Bank all ended lower, weakening market today sentiment.

3. Foreign Fund Outflows Accelerate

FIIs sold ₹2,133 crore worth of Indian equities yesterday. That’s ₹11,000+ crore outflow in just four sessions. It’s a major reason why the market is down today.

What Else Is Driving Market Sentiment?

Here are three angles many headlines are missing:

- High valuations: Bajaj Finance trades at a premium. At ~32x earnings, any bad news hits harder.

- Weak rupee: The INR has slipped closer to 87/USD, raising inflation and import costs.

- Trade uncertainty: Global investors are cautious ahead of U.S.–India tariff deadlines.

Takeaway for Investors

If you’re tracking the share market today, don’t just chase quarterly results. Keep an eye on:

- Asset quality trends.

- Valuation risks.

- FII flows and global signals.

Today’s market reaction shows that even well-run companies like Bajaj Finance can face sharp corrections when sentiment shifts. Balance short-term news with long-term fundamentals.